One choice you will have to make with your retirement money– if you are ever going to sleep well at night– is to determine if you are a long term value investor — or a market timing speculator. Let’s first define the difference between investing and speculating. An investment involves cash flow and return. Speculation does not. It is pure supply and demand, nothing more and nothing less.

When you analyze whether or not to buy any investment, you arrive at a fork in the road. Are you an investor or a speculator? Are you going to find companies with strong business models, making a profit within industries that are part of the future economy? Or–are you simply looking to “get in, get out, and get paid?”

“Getting in, getting out, and getting paid” sounds good on fix-and-flip TV shows, but has caused many investors to crash and burn, or to wind up with mediocre results.

The “getting in” and “getting out” part can work fine—it’s the “getting PAID” part that can be trouble.

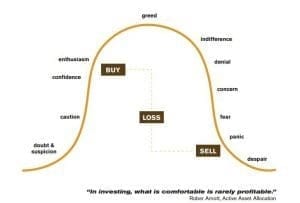

Even when you pick a winner here and there, you become confronted by other problems. When you own a stock that is rising, new worries begin such as, “should I get out now, or ride this puppy?” …”What if I sell, and it goes up? I’ll feel horrible. Better hang on.” Then you hear some good news about the stock on CNBC, it goes up another five percent, so you’ve confirmed it–You are a genius. Later that afternoon, some really bad news comes out, and the position falls by twelve percent. If you attach your sense of financial success to daily, weekly, or monthly ups and downs of a twenty-seven trillion dollar market (the current value of the Wilshire 5000), you may never find true financial peace. This is why I want my clients to live by a simple phrase with their money: “Insure your income, insure your outcomes, THEN invest the rest with purpose.” You can ride out ups and downs with more calm when you know all of your important bets are covered.

When you begin to believe that you are smarter than the market, the trouble begins. It’s like the four stages of tequila: Stage 1: I’m rich and funny Stage 2: I’m good looking Stage 3: I’m invincible Stage 4: I’m bullet proof.

Professional speculators know their limitations. They buy both short and long positions simultaneously known as collars, based on serious calculations. They know they will be wrong on one part of the trade going in. Their goals is to win more often than they lose. In fact, they don’t really believe in luck. GREAT speculators pay good money for insurance—which they get when they go both long and short. The insurance both costs money and SAVES money. In the dicey, fast moving world that day traders and speculators live in, buying insurance against failure is not only a good idea–it is necessary for long term survival. You might hear about a big speculative win by a trader. You might not hear how much money was placed on the opposite position, and lost in the transaction. One half of every trade by professional speculators loses money. Big speculators that last do not go “naked” into the world of risk. They diversify and they buy insurance positions. There is a lesson there for every retired investor.

Many people like to believe they are “INVESTORS”—it sounds much better than being a speculator. But how would you describe the person who goes into a well thought out investment, meeting a checklist of strong criteria that has resulted in long term success for decades, based on cash flow and market metrics, who becomes disenchanted three weeks later if the price suddenly falls?

Is this person a true investor, or IN REALITY a market timer at heart—and better classified as an amateur speculator?

There is an old expression that applies here: KNOW thyself! In other words, KNOW if you are a speculator, an investor or a saver. A saver is someone who doesn’t want to lose any money, ever, period! There’s nothing wrong with that, if you can afford it! Unfortunately, traditional savings vehicles like bank CDs and money market accounts pay next to nothing and actually lose money after taxes and inflation.

Therefore, many retirees who are conservative with their money still want to keep their fishing pole in the water. They’re not over the hill yet and are still looking for growth.

Some keep money in mutual funds and keep telling themselves the risk doesn’t bother them—until the market falls about seven to ten percent. Suddenly the pole comes out of the water! Any investor who can’t withstand swings of ten to fifteen percent in the market, should stay completely away from it. Markets don’t always go up. They also come down. Smart investors can hardly wait for the dips to increase positions in strong companies. Conservative savers jump ship.

The person I’m describing here is a saver, not a speculator, not even an investor. AND, again, there is not one thing wrong with that! If you have saved enough money to live on, and going backwards at this stage of the game would be a shock and a terror to you, simply recognize it and embrace it. It is not a bad thing, in fact it is a smart thing, to preserve what you have worked, saved, and invested for your whole life.

Just stop and think for a moment–if you made another twenty percent on your current investments, would it really change your lifestyle any? Probably not! But what if you lost fifty percent of your money? That might have a serious effect! Some risks simply aren’t worth it.

Speculating is not a bad thing necessarily—you just need to be aware that you are speculating, not “investing”. You see, when you speculate, your hopes are pinned on more people than you ..wanting what you have at some unknown date in the future. Will they or won’t they want it? You don’t know.

Investments, on the other hand, are long term positions, like rental properties. Let’s say you bought a 4-plex, and it was paying you good rent in a good location. Your cash flow from the property was $4,000 a month with employed tenants whose incomes were rising every year. It is well maintained with a solid roof and good plumbing. Because of the excellent cash flow, you would have the right to call it an “investment”, not just a speculation.

If the 4 plex was bringing in enough rent to give you back your entire down payment in ten or fifteen years, you would still own the building and could sell it. Because you received the rent equal to all the money you put in, it follows that all the dollars you sell it for– are pure profit!

Most of us would say you made a great “investment.” We wouldn’t call you a pure “speculator.”

The same is true with a dividend stock or ETF. If you keep reinvesting the dividends and one day the sum total of those compounded dividends equals what you put in, the price you could sell the stock for would be pure profit. Those are TRUE investments.

Here’s a Question: If you had great tenants, and you kept getting great rent, but then a real estate recession comes along, and takes the value of your property down by twenty percent temporarily—BUT THE RENT IS STILL COMING IN WITH NO reduction—would you sell that property right then? Probably not.

Investing entails vision. You have to know where you are today, and where you want to go in the future. Are you going to nervously watch the markets and question every decision you’ve ever made because the herd is running toward the cliff? Or are you going to stick to your guns and realize that the market will eventually find its way back to companies that make real money doing real things that benefit the real economy?

Stocks don’t always go up. Real estate doesn’t always go up. What’s your plan for when they both fall—which is entirely possible.

Which types of stocks do you want to own when the next correction occurs—those that are still making money and still paying you dividends to own them, or stocks that you have no math or evidence to back up your choice. In other words, you are only hoping it goes up one day? Having a defined entry and exit strategy is very important to the true investor.

Retirement Tip: The most important thing you can do in retirement is to separate your income capital from your growth capital.

Get a very good handle on your expenses, and decide to cover those expenses with guaranteed lifetime income, like social security, pensions, and annuities. Once you’ve done that, you are free to invest and even speculate without fear.

On the other hand, if you know down deep that you are a saver, not a speculator, look into the Next Generation of principal protected index annuities with uncapped strategies. Go up with your money, never down, forward, never back.