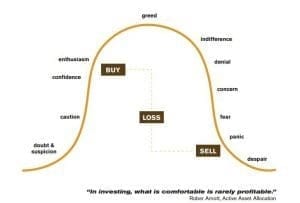

After the 2008 crisis, investor confidence hit an all-time low. Low confidence led to more sell-offs and things looked grim until the summer of 2009. Finally, investors got their mojo back. That’s the reality of the market: until confidence returns, the market will stay down. When markets fall and stay down, many investors question their entire investing approach. Rather than feeling like investors, they may feel like they are simply gambling with their money.

The market can take investors to emotional high’s, only to drop them down to emotional lows—much like what occurs at the Las Vegas gaming tables. But is investing really the same as gambling?

Well, that depends on your strategy and whether or not you ACTUALLY HAVE a strategy with some form of mathematical basis. If you don’t, you may feel that you are playing cards, not building wealth.

Good stock investing is not the same as gambling for several reasons. Poker-chips and playing-cards don’t EARN anything. They are inanimate objects with no inherent value. With chips and cards, you have no control of any kind over the outcomes. If you are an ultra-skilled card-counter, you still have no real control over the cards being dealt but your odds of guessing right get higher.

The stock market is different, especially for those with a long term view. In the short run, especially for day traders, the market is very random and unpredictable and is gambling. For reasonable, longer term investors, the market provides true quantifiable opportunity to buy companies that make consistent profits. Unlike playing cards and poker chips, stocks represent ownership in real live companies that hire people and make things. There IS real value in the stock of a company that is CONSISTENTLY profitable. Are some stocks almost purely a gamble? Yes, and if you’re smart you’ll avoid them.

Let’s remember that a share of common stock is ownership in a company. It entitles the holder to a claim on assets as well as a piece of the profits that the company generates. If the company pays dividends, it entitles you to the payment of cash back into your account on a regular basis, usually quarterly. Dividends are not interest, they are a share of real profits the company has made. The company is paying YOU to own its stock.

Too often, however, investors think of shares as simply a commodity, and they forget that a share of stock represents the ownership of a company. They attempt to catch a wave going up, and to neatly jump off the wave as it goes down. Surfers do that at Hermosa Beach all the time. Surfing might look easy from the beach but once you get out on the board, you learn why you’re a spectator.

Now, if you get miffed by the markets and wonder what really drives the stock market, it is profits and earnings. The market REACTS to earnings, which is why short term market timers are so interested in earnings REPORTS. This is why stock prices fluctuate—it is all about the REACTION by large numbers of investors to the published earnings of a company and whether or not they beat the estimate– or fell short. You hear it every day on the news.

The outlook for business conditions is always changing, as are the future earnings of a company. Those companies that consistently grow their earnings and lead the pack within their industry will be in higher demand by knowledgeable investors who seek safer bets with their money. Therefore if you gravitate toward profitable companies and buy them at reasonable prices, you stand the chance of benefiting from the long term profitability of those superior companies. You are doing what basketball great Larry Bird and hockey great Wayne Gretzky always did: running or skating to where the puck is going, not where it’s been.

One way to seek long term value is to invest in companies that pay dividends. But that isn’t always enough. You don’t want any flash-in-the-pans. You want companies that are solid. So solid in fact, that they raise their dividends every single year. If you buy profitable companies that not only PAY dividends but increase their dividends every year, and have demonstrated at least a ten-consecutive-year-track-record of increasing dividends, you are building a system of owning high quality profitable companies.

That said, you could still pay too much for a stock, even though it pays consistent dividends. So you need some way, some system, of determining whether a stock is priced too high before you buy it. You can look at simple valuation methods like the price to earnings ratio, but that won’t tell you the whole story. You need more methods of determining whether or not a stock is priced reasonably.

Beware of Stocks Paying “High Dividends”. There Is A Catch

I always know I’m talking to a less experienced investor when they are attracted to “high dividend” stocks. Great companies in normal markets pay between 2% and 4% dividends, and may grow their dividends by 4% to 12% annually. Poor companies, barely hanging on, may offer dividend yields in the 6% to 10% range. Run the other way–something is wrong there.

It’s easy to fall for the notion that the higher the dividend yield the better the stock– UNLESS you are experienced. A high dividend yield can in fact be the surest sign of a company in trouble!

Allow me to explain. First, the dividend yield is not an interest rate. If company ‘A’ has a three percent dividend yield and company ‘B’ has a 9 percent dividend yield, company B is NOT a three-times-better company. In fact, the opposite is true. The nine percent dividend yield stock may only be worth a THIRD of the three percent dividend-yield-stock.

How can that be? It’s because dividend yield is a mathematical expression of the amount of dollars per year being paid in dividends in relation to the share price. Keep it simple. If a company is trading at a hundred dollars a share and declares a three dollar dividend this year, you’re the proud owner of a three percent dividend yield.

But if the share price moves up to a hundred and FIFTY dollars a share and the dividend is still three dollars, you divide your three dollar dividend by a hundred FIFTY, and you find that your new dividend YIELD is only 2%.

Conclusion: This stock may have gone up too far, and now be priced too high. But now, let’s look at the OPPOSITE case. If the SHARE PRICE got cut in half down to fifty dollars—like in 2008, the three dollar dividend now translates to a SIX percent dividend yield. Same company, same real world earnings, but the stock price has fallen. Is the stock a good buy? Maybe. It depends on many other factors.

Now let’s suppose the same stock gets decimated all the down way to THIRTY-THREE dollars a share. Well, the dividend YIELD MATHEMATICALLY rises to NINE percent. Question: would you really want to own that company—after it has fallen by sixty seven percent and the rest of the market only fell by fifty percent? Probably not.

This is why– with the Black Diamond Dividend strategy— we buy only PROFITABLE companies WITHIN a disciplined dividend yield range—not too high, not too low. It helps us find diamonds in the rough, and tells us when to cut loose of stocks we no longer want. We buy only companies that have increased their dividends every single year for a minimum of ten consecutive years. The companies need to be leaders in their field with a competitive advantage at what they do. We require investment credit ratings (many stocks with 9% dividend yields have credit ratings in the junk category.) My advice: buy quality assets, get paid to own them, and demand that your companies raise their dividends every single year.

Steve Jurich is an Accredited Investment Fiduciary and Wealth Manager with IQ Wealth Management in Scottsdale, a registered investment adviser. He is a Kiplinger contributor and his radio show MASTERING MONEY can be heard daily on KFNN, AM1510 from 8-9am monday through friday. Podcasts are available here